In the world of spirits, tequila has emerged as the toast of the town, witnessing unprecedented global growth. While the Indian market for tequila is still nascent, its rapid expansion, driven by a newfound appreciation for premium offerings, presents a fertile ground for innovation.

Recognising this trend, Louis Vuitton-Moët-Hennessy has launched Volcan de Mi Tierra tequila in India.

To gain a deeper understanding of this strategic move, we spoke with Smriti Sekhsaria, marketing director, Moët Hennessy India. She shared insights into the brand’s commitment to sustainability, the rationale behind getting Carlos Crain L Corcuera as the face of Volcan, its focus on premiumisation, and its targeted marketing strategy.

Sekhsaria offered a unique perspective on Volcan tequila’s vision to reshape the Indian market and reflected on LVMH's remarkable journey of sustained success in India over the past decade.

Edited excerpts:

Is tequila evolving as a premium category in India as it is globally? What inspired the launch of Volcan Tequila here?

To start with some numbers, the global tequila market is around 50 million cases, growing steadily at mid-single digits. In contrast, India’s nascent market, with about 1,000 cases, has seen 2-3x growth in the past 6-8 months, according to IWSR (International Wine and Spirits Record) H1 data, signalling a strong upward trend.

An intriguing trend is the premiumisation of tequila globally and in India. Globally, 50% of the market value comes from premium and above segments, reflecting a strong appetite for luxury. In India, the premium segment is outpacing lower tiers, with global premium growth at 8% while lower-end categories see a decline, underscoring the shift toward high-end offerings.

At Moët Hennessy, part of a portfolio of 78 luxury brands spanning fashion, beauty, retail, and F&B, it’s only natural for us as a wine and spirits leader to venture into such a promising segment. This is especially true given the tequila category’s rapid growth and its alignment with our focus on premium spirits.

Our partnership with the Gallardo family, who has been part of the tequila ecosystem since the mid-1700s, allows us to combine their rich heritage with Moët Hennessy’s global distribution capabilities. This synergy positions us perfectly to bring Volcan Tequila to India and cater to its growing base of luxury-conscious consumers.

What strategies will you employ to make the Volcan Tequila stand out as a luxury choice in India’s competitive market?

In a competitive market like India, luxury aligns with global standards through innovation, authenticity, and excellence, core to Moët Hennessy’s ethos. Authenticity is vital in the tequila ecosystem, where 2,200 brands share just 169 distilleries, but only five produce single-brand, additive-free tequilas.

Volcan stands out as one of them, delivering purity through 100% Blue Weber Agave, matured for six years to ensure natural sugar formation without additives. This handcrafted approach exemplifies authenticity and craftsmanship, appealing to India’s discerning, well-informed consumers.

Volcan is crafted from 100% Blue Weber Agave, meticulously matured for six years to naturally develop its sugars, free from any additives.

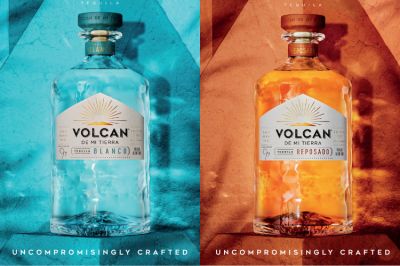

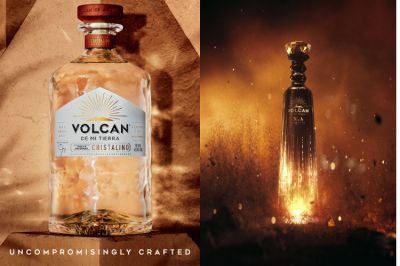

Innovation is equally vital. Volcan introduces four products: Blanco (INR 10,267), offering a citrus-floral balance; Reposado (INR 12,198), aged in American and European barrels for nutty notes; Cristalino (INR 15,967), a charcoal-filtered Reposado with a silky smooth finish; and the pinnacle, Volcan XA (INR 39,107), a blend of Reposado, Añejo, and Extra Añejo, aged in cognac and whiskey barrels, showcasing masterful blending.

(From top left clockwise: Blanco, Reposado, Cristalino and Volcan XA)

With this combination of authenticity and innovation, Volcan is poised to resonate with India’s luxury spirits market, offering a refined experience for the evolving consumer palate.

What is the trend surrounding premiumisation in India? How does the brand view premiumisation shaping the future of tequila and the Indian spirits market?

Post-Covid, premiumisation has surged, especially in the luxury mindset, with premium products growing strongly year on year. Some top-tier offerings now see 21% annual growth, as consumers opt for higher-quality drinks, often drinking less or experimenting more. For instance, whiskey drinkers are shifting from blended to single malts, reflecting this trend.

This shift aligns perfectly with our portfolio. We introduced Armand de Brignac, among India’s most expensive champagnes, and launched Chandon’s first vintage sparkling wine from Nashik at INR 10,000. Additionally, we unveiled Aurva, a premium red wine celebrating India’s Shiraz grape, now one of the country’s priciest reds.

With a growing luxury portfolio, we’re embracing this trend while showcasing Indian craftsmanship globally.

How will Carlos Crain L. Corcuera, as global brand ambassador, help drive awareness and adoption of Volcan tequila?

We draw inspiration from Mexican heritage, particularly the craftsmanship behind tequila, passed down through generations. Our focus is on telling the story of authenticity, from being a single-brand distillery to creating additive-free tequila.

One key part of this story is Carlos, our brand ambassador, who passionately speaks about the artistry and craftsmanship behind our products. Every bottle of Volcan is hand-painted and hand-labelled, nothing is produced on a production line. From field to bottle, it’s all handcrafted.

Carlos is key in educating our team and partners across trade, retail, and hospitality, especially regarding our product’s essence, ensuring a clear and consistent consumer message is executed. This commitment to education is reflected in all our market communications.

With India’s advertising restrictions on spirits, how do you creatively navigate surrogate advertising for Moët Hennessy? Could you share some unique approaches?

We’re in the luxury business, and alcohol happens to be the product we offer. High-end brands, like Dior with their Paris atelier café, focus on creating experiences rather than relying on surrogates.

At our winery, we create memorable brand experiences through hospitality, guiding guests through tastings, cocktails, and food. It’s all about offering a unique experience.

For Moët Hennessy, luxury communication is driven by PR and earned media, prioritising organic voice and owned media over paid. In compliant markets, we engage with customers in-store, always adhering to local regulations.

Ultimately, editorial content and PR strategies are central to our approach, ensuring that everything we communicate aligns with the essence of the brand.

Reflecting on Chandon India’s decade under LVMH, what were the unique challenges of establishing a luxury sparkling wine in a spirit-dominant market? How do sustainability and local craftsmanship guide Chandon’s vision for the next decade?

As we reflect on our ten years, we recognise that we’ve been operating in a very niche category within the wines and spirits industry. To put it into perspective, wines make up just 1% of the total market, and Chandon represents only 1% of that. Our primary goal is to grow that market. Over the past decade, what we’ve learned and what will guide us in the years ahead is the importance of education. We need to educate consumers and partners about what sparkling wine truly is not champagne or prosecco and the role it can play in people’s lives.

Creating occasions for sparkling wine is crucial, and we’ve seen success in introducing it as the perfect drink for brunch. This is part of a broader effort to shape drinking occasions. Another key aspect is innovation producing products that appeal to the Indian consumer and their preferences.

Innovation has been key to our success and will drive our growth. In just ten years, Chandon has won over 40 awards from prestigious global competitions like the Decanter Awards and the World Champagne and Sparkling Wine Championship. This showcases India’s craftsmanship, even in categories like sparkling wine, traditionally not native to the country. We remain committed to continuing this legacy and bringing exceptional products to market.

Which Moët Hennessy spirits and wines brands have a larger marketing share and what has contributed to their success?

Moët Hennessy’s market leadership reflects our robust reach across categories. We hold over 75% of the champagne market and nearly 60% in cognac. Glenmorangie, a newer player, has made notable progress, though still in the single digits, and remains a key focus for growth.

Chandon, within the small sparkling wine segment, holds over 50% market share. The challenge is expanding the segment itself, with growth driven by focusing on whiskey and other key areas in India, where we’re investing in whiskey and Chandon.

With digital purchasing on the rise, how are you adapting your strategies?

A lot of this comes down to government regulations, both at the central and state levels. Some states, like West Bengal, have allowed home delivery, while others are still considering it. As a luxury brand, we’ve learned that we can provide exceptional experiences for consumers, whether digitally or in person. Moët Hennessy is dedicated to crafting memorable moments in both settings.

Digitally, the rise of quick commerce means our content must be focused and engaging, as people process information faster than ever. While the government addresses regulations, improving this area remains crucial for us.

As transparency gains importance with Gen Z and millennial consumers, how is Moët Hennessy addressing this through sustainable practices? Are there certifications or sourcing distinctions for Moët Hennessy in sustainability?

As consumer awareness grows, they seek more information. At Moët Hennessy, we focus on this through our global "Living Soils" program, which recognises the agricultural nature of our industry. The program has four main goals: regenerating soils, fostering a positive environment for employees, ensuring a positive climate impact, and promoting sustainability.

At the Chandon Winery, we have seen positive results, with over 50% of our electricity from solar panels and 100% of irrigation managed through drip systems for water efficiency. Internationally, 80% of our wineries are pesticide-free and progressing further. We're committed to leading the way in this space.

What are Moët Hennessy's long-term goals in India to scale?

Our strategy begins with the product and its innovation story. We've focused on introducing luxury tequila and innovating within our whiskey portfolio, including launching an 18-year-old Glenmorangie with fresh appeal and expanding the range to match evolving consumer tastes.

In India, we innovate to align with local preferences while maintaining our global heritage. Desirability is key and we aim to create aspirational connections with a youthful, affluent demographic. For instance, Glenmorangie’s vibrant personality resonates with this audience, exemplified by our collaboration with resort-wear designers Shivam Bhatiya's Shivam and Narresh to create luxury couches inspired by cherished whiskey moments at home. This designer synergy, guided by master distiller Dr Bill Lumsden, fostered organic PR and engaging conversations.

For Chandon, we've reimagined rituals like sundowner evenings and brunches, building these moments as key occasions to enjoy our products through thoughtful campaigns and collaborations.

Our approach weaves products into Indian consumers' lives while preserving global essence, blending innovation with cultural relevance.