Warc has released 'The Future of Programmatic 2024' report that covers the major trends shaping programmatic advertising over the coming 12 months, together with practical guidance for advertisers evolving their programmatic and ad tech capabilities.

The report highlights key trends across five different areas: programmatic priorities and concerns, signal loss and cookie deprecation, supply chain transparency, sustainability, and spending intentions.

The findings are based on an survey of 100 programmatic experts, conducted in July 2024 by Warc in partnership with B2B market research company, NewtonX, and complemented by external research.

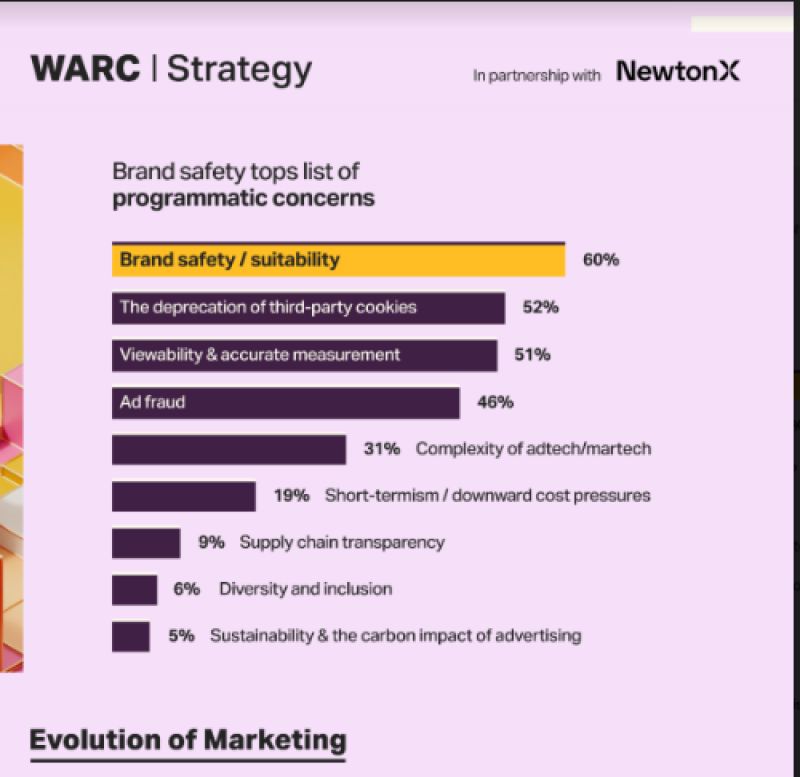

The report outlines key challenges such as:

Brand safety is a top concern for more than half (60%) of advertisers and agencies surveyed

Recent reports have shown advertisers are spending millions of dollars on low-quality ad placements that violate brand safety standards. More than half (60%) of the advertisers and agencies surveyed highlighted this issue as one of their biggest causes for concern, with 56% selecting improved advertising verification capabilities as a top priority.

Advertisers are underprepared for a cookie-diminished world.

Google will no longer be withdrawing cookies from the digital advertising ecosystem, but will nonetheless play a diminished role in the future. Many advertisers are still struggling to adapt to this new world, despite concerns about the impact of signal loss on various areas including targeting, data access, audience segmentation and measurement. Only a quarter (25%) of survey respondents agree that advertisers are making adequate progress.

Consistent with other research, advertisers are doubling down on the collection of first-party data. More than three quarters (76%) of respondents are implementing first-party data strategies, with more than half (57%) highlighting this as the most promising solution.

The industry is failing to take action on transparency

Across the programmatic advertising supply chain, ad fraud and wastage are rife. According to the ANA’s programmatic study, just 36 cents of every dollar spent on programmatic advertising reaches the consumer, and a quarter of the $88 billion spent on open web programmatic is wasted on low-quality and fraudulent ad impressions.

However, a year on from the report less than half (49%) of advertisers and agencies have established direct contracts, or taken the necessary steps to verify or audit the quality of ad impressions. Collective action is required to urgently address these issues and clean up the ‘murky’ media supply chain.

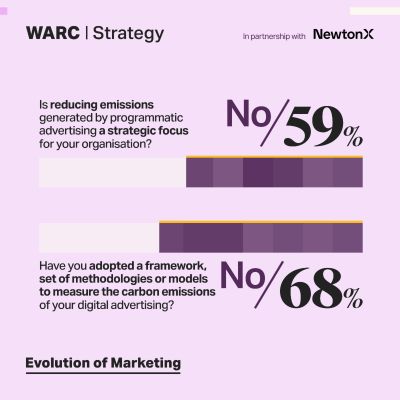

Reducing emissions generated by programmatic advertising is not a priority for nearly two-thirds (59%) of companies

The programmatic advertising industry produces more than 2,15,000 metric tons of carbon emissions in a single month across five leading economies, according to Scope3.

Nearly two-thirds (59%) of agencies and advertisers surveyed for the report say that reducing emissions generated by programmatic advertising is not a priority for their organisation. Less than a third (31%) said they had adopted a framework or set of methodologies to measure the carbon emissions from their digital advertising. Another third (34%) have taken no action at all to reduce the carbon impact of their programmatic advertising campaigns.

Open web investment decreases as walled garden spend grows

Three quarters of respondents (76%) are spending 40% or less of their budgets on open web advertising (i.e. publishers that aren’t walled gardens like Facebook/Meta, Google and Amazon).

Despite evidence suggesting that the open web remains the arena in which audiences spend most of their time, investment in walled gardens appears to be growing. Warc forecasts predict that just five platforms will take over half of global advertising spend this year. Three-quarters of survey respondents (76%) say they are spending 40% or less of their budgets on open web advertising.

Advertisers and agencies are opting to spend more on programmatic direct deals (e.g. programmatic guaranteed, preferred deals) at the expense of traditional real-time bidding. More than half (56%) of respondents purchase display inventory using programmatic methods. Retail media inventory also features high on the list of channels transacted programmatically. Social and gaming are anticipated to receive largest increases in programmatic investment.

Paul Stringer, managing editor research and insights, Warc, said, “Our Future of Programmatic report arrives in the wake of the announcement from Google that third-party cookies will no longer be fully phased out from the advertising ecosystem. While it represents a reversal of sorts, this should not encourage complacency. The industry still needs to evolve to meet the demands of a privacy-first ecosystem.

“Declining addressability, brand safety and ad fraud, continue to concern marketers, and addressing these concerns becomes even more important as increasing volumes of spend are transacted programmatically each year.”

Wayne Blodwell, co-founder and CEO, Impact Media, said, “Google’s decision to keep cookies has not changed the direction of travel for the industry. Advertisers should continue leaning into smart, cookie-free techniques like attention and econometrics to prepare for a privacy-first world.”

.gif)